Financial Strategy Is the Missing Link in Business Growth.

“82% of businesses fail due to poor cash flow management.” — CB Insights: Top Reasons Startups Fail

Many startups and small businesses fail due to weak financial management, not flawed ideas. Unpredictable cash flow, lack of forecasting, and limited financial strategy can stall or completely derail business growth.

Fractional CFO services address this gap. They provide executive-level financial leadership on a flexible basis, without the cost or commitment of a full-time hire. Whether your company is preparing for fundraising, scaling operations, or navigating uncertainty, a fractional CFO offers the guidance necessary to move forward with clarity and confidence.

What Is a Fractional CFO?

A Scalable Financial Leadership Solution

A fractional CFO is a senior finance executive who works with your business on a part-time or project basis. They bring the same strategic capabilities as a full-time CFO, but are engaged only as needed, making them ideal for high-growth startups, lean teams, or businesses preparing for investment or transition. They help you make better decisions and manage risk. They also help you plan for growth. If you’re raising funds or scaling up, this kind of support can be the difference between moving forward or falling behind. If you’re not ready to bring someone on full-time, you can hire a fractional CFO on a flexible basis just when you need them most.

This model provides:

- Expert-level financial strategy without long-term payroll costs

- Support aligned with your current stage of growth

- Flexibility to scale financial guidance as business needs evolve

A fractional CFO gives you senior-level financial strategy without the cost of a full-time hire. This article shows how a fractional CFO helps businesses grow faster and make smarter financial decisions.

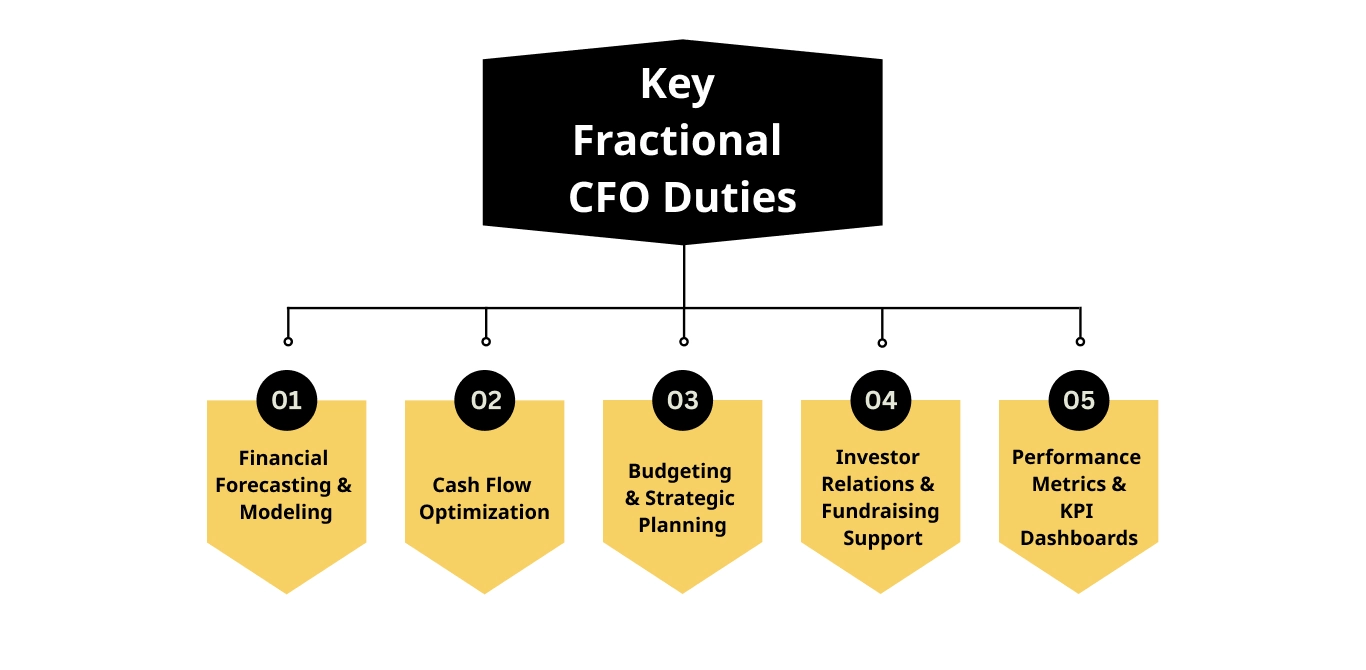

Key Fractional CFO Duties

- Financial Forecasting & Modeling Develop clear, accurate forecasts and financial models to support strategic planning and scenario analysis.

- Cash Flow Optimization Improve cash visibility, address inefficiencies, and ensure working capital is aligned with business goals.

- Budgeting & Strategic Planning Design structured budgets that reflect organizational priorities and support scalable growth.

- Investor Relations & Fundraising Support Prepare financial materials for fundraising, manage due diligence processes, and advise on investor communications.

- Performance Metrics & KPI Dashboards Implement clear, data-driven systems to measure success and drive operational improvement.

Fractional CFO vs. Full-Time CFO

Hiring a full-time Chief Financial Officer is expensive, and for many startups, the cost is not feasible. Fractional CFOs give you the same level of expertise, but you only pay for what you need. For example, they can be hired for a specific project or for few hours a week to help with financial planning, budgeting, and business consulting without the long-term commitment. One of the key benefits of a fractional CFO is that you receive senior support without stretching your budget.

Here’s a clear, side-by-side comparison table showing the differences between them.

| Category | Fractional CFOs | Full-Time CFO |

|---|---|---|

| Cost | Pay only for hours or projects needed. No salary, benefits, or overhead. | High fixed salary, benefits, and long-term overhead. |

| Flexibility | Scalable support based on business needs. | Fixed role with limited flexibility. |

| Expertise Access | Senior-level Chief Financial Officer guidance without full-time commitment. | Full-time access to strategic leadership. |

| Financial Planning | Short-term help with planning and forecasting. | Regular support with budgets and reports. |

| Business Consulting | Often includes business consulting and advisory services. | May focus more on internal operations and reporting. |

| Startup Finance Fit | Works well for startups with tight budgets and quick changes. | Fits bigger companies that have steady cash flow. |

| Benefits of a Fractional CFO | Lower cost, more flexibility, and quick access to expert advice. | More stability and a stronger connection to your team over time. |

Strategic Impact

How Fractional CFOs Drive Smarter, Faster Growth

A strong financial strategy is central to business growth. Fractional CFOs bring structure, insight, and accountability to the financial side of your business, creating a foundation for better decisions and faster execution.

Strategic Benefits Include:

- Improved Financial Visibility

Make decisions based on real-time financial data and performance metrics. - Investor Readiness

Present a clear, credible financial story when raising capital or preparing for acquisition. - Operational Efficiency

Align resources to maximize return on investment and minimize unnecessary spending. - Growth-Driven Planning

Create financial roadmaps with clearly defined milestones and scalability in mind.

According to McKinsey, businesses with CFO-level strategic guidance grow up to 30% faster on average.

Benefits of a Fractional CFO for Startups and SMBs

For early-stage companies, the benefits of a fractional CFO go beyond cost savings:

- Make decisions faster with clear data: You get clarity without waiting or guesswork.

- Better investor trust: Your numbers are clear, and your pitch is easy to follow.

- Leaner operations with higher ROI: You spend smarter and grow cleaner.

This is especially true for a fractional CFO for business startups, where every move counts and every dollar matters.

“Companies with CFO-level guidance grow 30% faster on average.” — source: McKinsey

Here’s a clear, side-by-side growth curve comparison table showing how businesses who hire a Fractional CFO typically perform versus those without strategic CFO services.

| Without Strategic CFO Services | With Strategic CFO Services |

|---|---|

| Slow, inconsistent revenue growth | Steady, forecasted revenue acceleration |

| Frequent cash flow issues | Proactive cash flow planning and control |

| Reactive decision-making | Smart planning based on real data |

| Lost chances to raise money or build partnerships | Timely investor readiness and outreach |

| No clear financial roadmap | Defined growth milestones and KPIs |

| High burn rate, low ROI | Optimized spending and resource allocation |

| Stalled scalability | Scalable systems and financial infrastructure |

Use Cases & Industry Fit

- Tech Startups: Tech startups move fast and spend quickly. They often need help tracking costs and building investor decks. They also need support with financial planning and forecasting. A fractional CFO helps them stay focused and ready for funding without overspending.

- Dental Practices: Dental clinics deal with insurance payments and equipment costs. They need clear financial systems and smart budgeting. That’s where fractional CFO Services help bring structure and control to everyday decisions.

- Logistics Firms: Logistics businesses face slim margins and shifting demand. They manage complex contracts with multiple vendors. They need help managing costs and planning their fleet. They also need support with tracking and controlling cash flow. A fractional CFO brings structure and supports smart growth.

- Sustainability Ventures: Green startups often use grants and support from impact investors. They also focus on lasting results and staying true to their mission. A Fractional CFO helps match their mission with the numbers, tracking things like carbon savings and ESG goals.

How to Hire the Right Fractional CFO

Choosing the Right Strategic CFO Services Partner

The right CFO partner will not only understand your numbers, but also your industry, tools, and long-term goals.

Important Qualities:

- Relevant Industry Experience

Look for a CFO with hands-on experience in your sector. Generic expertise may not translate to your specific challenges. - Strategic Communication Skills

Clear, practical advice is essential. Avoid candidates who rely on jargon over substance. - Technology Proficiency

Familiarity with your tech stack, whether ERP systems, BI dashboards, or financial modeling tools, is critical for seamless integration. - Advisory Mindset

Choose someone who offers actionable insights, not just reports. They should contribute meaningfully to key decisions and long-term planning.

Questions to Ask Before You Hire

- What is your typical engagement structure (hourly, monthly, project-based)?

- How do you define success in a client engagement?

- Can you share case studies or references from similar companies?

- What financial tools and platforms are you proficient with?

- How do you contribute to strategic decision-making beyond reporting?

These questions will help ensure you select a CFO who is not only technically competent but also aligned with your business goals.

Where to Find Trusted Fractional CFOs

When looking for a good fractional CFO, it’s critical to find someone reliable, experienced, and easy to work with. Here are a few places to start:

- Fractional CFO consulting firms: Specialized firms like The Field Group offer fractional CFO consulting. We worked with startups, clinics, and growing businesses. You’ll find vetted, expert professionals.

- Professional networks: LinkedIn and Toptal are solid options. You can check profiles, read reviews, and see who’s worked with similar companies.

- Industry-specific platforms: Some sites focus on finance talent for certain sectors like tech, healthcare, or logistics. These platforms help you find someone who understands your space.

Why Work with The Field Group?

- Strategic financial leadership tailored to your growth stage

- Deep industry knowledge across tech, healthcare, logistics, and sustainability

- Hands-on support for fundraising, forecasting, and performance tracking

- Clear, actionable insights—not just reports

FAQs:

What is a fractional CFO?

A fractional CFO is a part-time or contract-based Chief Financial Officer who provides high-level financial strategy, planning, and analysis without the cost of a full-time hire.

How does a fractional CFO help my business grow?

They bring strategic financial insights, improve cash flow management, optimize budgets, and help scale operations—all tailored to your growth stage and goals.

When should a business consider hiring a fractional CFO?

Typically, growing businesses that lack in-house financial leadership but need strategic guidance for scaling, fundraising, or improving profitability should consider one.

What’s the difference between a fractional CFO and a full-time CFO?

A fractional CFO works part-time or on a project basis, offering flexibility and cost-efficiency, while a full-time CFO is a permanent executive with a higher overhead cost.

Is hiring a fractional CFO cost-effective for startups and small businesses?

Absolutely. You get executive-level financial expertise at a fraction of the cost, with services tailored to your current needs and scalable as your business grows.